The state of Wisconsin has introduced an electric vehicle charging tax of three cents per kWh delivered over any Level 3 charger that goes up to 250 kW, or over Level 1 and Level 2 chargers installed after March 22.

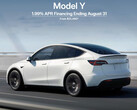

This means that, for every Tesla Model Y owner in Wisconsin, a full charging session at those stations will now cost about $2.40 extra.

"The registration and excise tax applies regardless of whether the charging station is available for public use and whether there is a charge to the consumer for the electricity from the EV charging station," stipulates the 2023 Wisconsin Act 121. This likely means that even those legacy Model S or X owners who have free Supercharging for life, will now have to pay a fee.

This is on top of the already comparatively hefty $175 "combined electric surcharge fee" that is essentially an annual road tax that Wisconsin now levies on EV owners.

Staring January 1, 2025, all EV charging station owners or operators will have to register online with the Wisconsin Department of Revenue before they start "delivery or placement of electricity from an EV charging station that is subject to the excise tax."

Residential charging stations like the Tesla Gen 2 Wall Connector are not subject to the new Wisconsin EV charging tax, unless they are installed in public places like hotels. As reasoning for the extra EV charging tax, Department of Revenue Secretary Designee David Casey cites road maintenance:

The excise tax represents a crucial source of revenue for maintaining Wisconsin's roadways and infrastructure. It will help ensure continued funding for road repairs and construction as Wisconsin drivers increasingly make the switch to electric vehicles, while creating a more equitable system in which all drivers contribute to road maintenance costs.

After a long honeymoon with electric vehicle owners, an increasing number of states have started introducing exclusive annual road taxes. The EV taxes are usually higher than those for legacy ICE vehicles, and the states' revenue departments explain this with the fact that electric cars are heavier on average and bring more wear and tear on local roads.

Wisconsin's new levy on each EV charging session, however, sounds like double taxation for that same road maintenance reason.

Source(s)

Wisconsin DOR (PDF) via WTMJ