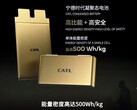

The drastic rise in the price of nickel, cobalt, and other metals that go into the cathodes of performance electric car batteries can't be eaten by the cell producer alone any more, advised the world's largest EV battery maker Contemporary Amperex Technology Co Ltd (CATL). While it has been absorbing the increased cost of raw materials for the batteries it produces, at some point this year the situation became unbearable, so it began outsourcing some of the price hikes to its numerous EV-making partners.

CATL is the main or a major battery supplier for many of them, including Tesla, and during a quarterly earnings interview it said that it has "renegotiated prices with customers to jointly address pressure from the supply chain." CATL is very sensitive to its battery pricing structure as it tries to become the industry's supply behemoth when it comes to mass-produced electric vehicles. It even turned down NIO's successful semi-solid state battery development advances with the argument that it is now trying to focus on production ramp-up and deliveries of regular cells for its numerous EV-making clients.

That is why it has been absorbing the cathode and other battery component materials' price inflation for a good while, but an increased pressure on its earnings has forced it to split the difference with its customers. CATL's revenue was 154% higher year-on-year for this past quarter, yet its net profit plunged 82% compared to the last quarter of 2021.

The main culprit for that financial underperformance are the operating costs that almost doubled compared to the same period last year due to a "rapid increase in upstream material prices." Industry analysts calculate that the nickel price increase alone would add US$1580 to the cost of a typical EV battery pack. Despite that companies like Tesla and Samsung hedged their nickel purchases, electric car prices have been on an upswing since the beginning of the year and CATL's move may speed up that trend further.