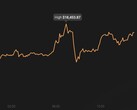

Bitcoin has been involved in a few controversies this year, most notable being the scalability issue involving Segwit and the few forks that were promising to fix this. Nevertheless, the crypto king managed to overcome all problems as it appreciated around 2,000% in 2017, of which ~1,000% occurred in the last few weeks alone. An event that contributed to this rally was the announcement of Bitcoin futures available through the Chicago Board Options Exchange (CBOE) and the CME group. Due to a surge in traffic, the CBOE site went down immediately upon the release of its Bitcoin futures this past Sunday, and Bitcoin appreciated around US$1,000 in the next 10 minutes, getting close to US$17,000.

Traders and investors can now purchase Bitcoin future contracts that are set to expire on January 17, 2018. According to CNBC, 672 January contracts have already been sold for $15,800, with auction prices reaching US$16,800. An interesting consequence of the futures is that they can help Bitcoin become less volatile, consolidating its price. This can already be seen on exchanges where the BTC price has oscillated very little around US$16,500 in the past 8 hours. On the other hand, Wall Street investors getting into Bitcoin trading could mean a less decentralized coin, going against the cryptocurrency credo. The CME will also release Bitcoin futures on December 18, while CBOE already plans to link cryptocurrencies to exchange-traded funds and notes in the near future.

The next two stepping stones for Bitcoin are the miner rewards halving and the jump to the Lightning network that should resolve the scalability issue once and for all. The miner rewards halving from February 2018 is expected to add more value to the crypto coin, as Bitcoin will become harder to mine.

Loading Comments

I first stepped into the wondrous IT&C world when I was around seven years old. I was instantly fascinated by computerized graphics, whether they were from games or 3D applications like 3D Max. I'm also an avid reader of science fiction, an astrophysics aficionado, and a crypto geek. I started writing PC-related articles for Softpedia and a few blogs back in 2006. I joined the Notebookcheck team in the summer of 2017 and am currently a senior tech writer mostly covering processor, GPU, and laptop news.

> Expert Reviews and News on Laptops, Smartphones and Tech Innovations > News > News Archive > Newsarchive 2017 12 > Bitcoin futures go online, price spikes close to US$17,000

Bogdan Solca, 2017-12-11 (Update: 2017-12-11)